Everything Credit Related!

Credit in Layman’s Terms: Your credit score is a three-digit number that can range from 300 to 850. It reflects your credit history and overall creditworthiness. The higher the number, the more likely you are to be approved. The 3 Credit Bureaus are: Equifax, Experian, & Transunion. The scoring model mortgage companies use is called FICO.

Lets go down the rabbit hole of CREDIT!!! Dis spell rumors, lets talk about why Credit Karma & Mortgage Companies pull 2 different scores. We are going to break down the FICO scoring model itself and help you get as much info as you want about how your score works.

Topics in this article.

- Mortgage Loans & Credit

- How Soon should you call to check Credit?

- Credit Score Models (VantageScore vs FICO)

- Breakdown of what makes your FICO score

- Credit Score Rumors & Myths

- What is a Credit Report?

- What is a Credit Score?

- What are the minimums to have a Credit Score?

- Does my FICO score change over time?

- How to get a copy of your FREE Credit report

- Credit Councelling, is it worth it?

How soon should I call you to check my credit before buying?

Sooner the better. Many people will wait until they are ready to buy before calling. The issue is, if there is something we need to fix or plan for, now there is no time to do it. Maybe you have to move in the next 3 months. When we talk there is never any pressure to buy before you are ready. We talk about the 3 main things you need to get a mortgage and ideally do an application so I can look over your credit and spot any issues before they cause any delay.

There is no such thing as calling to early! If you want to move in a year, lets talk now and plan out the next year credit wise and financially so you are in the absolute best position to buy what you want.

Credit Scoring Models – VantageScore (Credit Karma) vs FICO (Mortgage)

- FICO and VantageScore are two different companies

- Both companies create credit scoring models

- Their models give different levels of importance to different information in your credit reports

One way the two main credit scores use their credit scoring models differs by the method each one uses to pull your credit history.

A snapshot of all the available credit accounts, payment history, and historical data determines FICO Scores when it was generated. A Vantage Score focuses more on your credit account history and informs lenders of your credit behavior, payment history, and trended data.

Generally if you have a Credit Card that offers “free credit scores” it will use VantageScore. If you look at the scoring model, it will tell you the exact scoring model that’s used.

Both types of credit scores use a variety of similar factors to create your credit score from the trended data in your credit report. However, the defining difference is how much these factors influence your credit score. While both credit scores look at your credit report to examine your credit accounts, credit limit, credit history, payment history, hard or soft inquiries, and available credit, each factor influences differently each score to determine a possible credit risk or a good credit score.

Although both scores are useful, around 90% of lenders use the FICO Score to evaluate potential consumers when they want to qualify for a credit card, new car, loan, or credit limit increase.

Two of the biggest companies when it comes to credit scoring models are Fair Isaac Corporation, or FICO, and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus – Equifax, Experian and TransUnion.

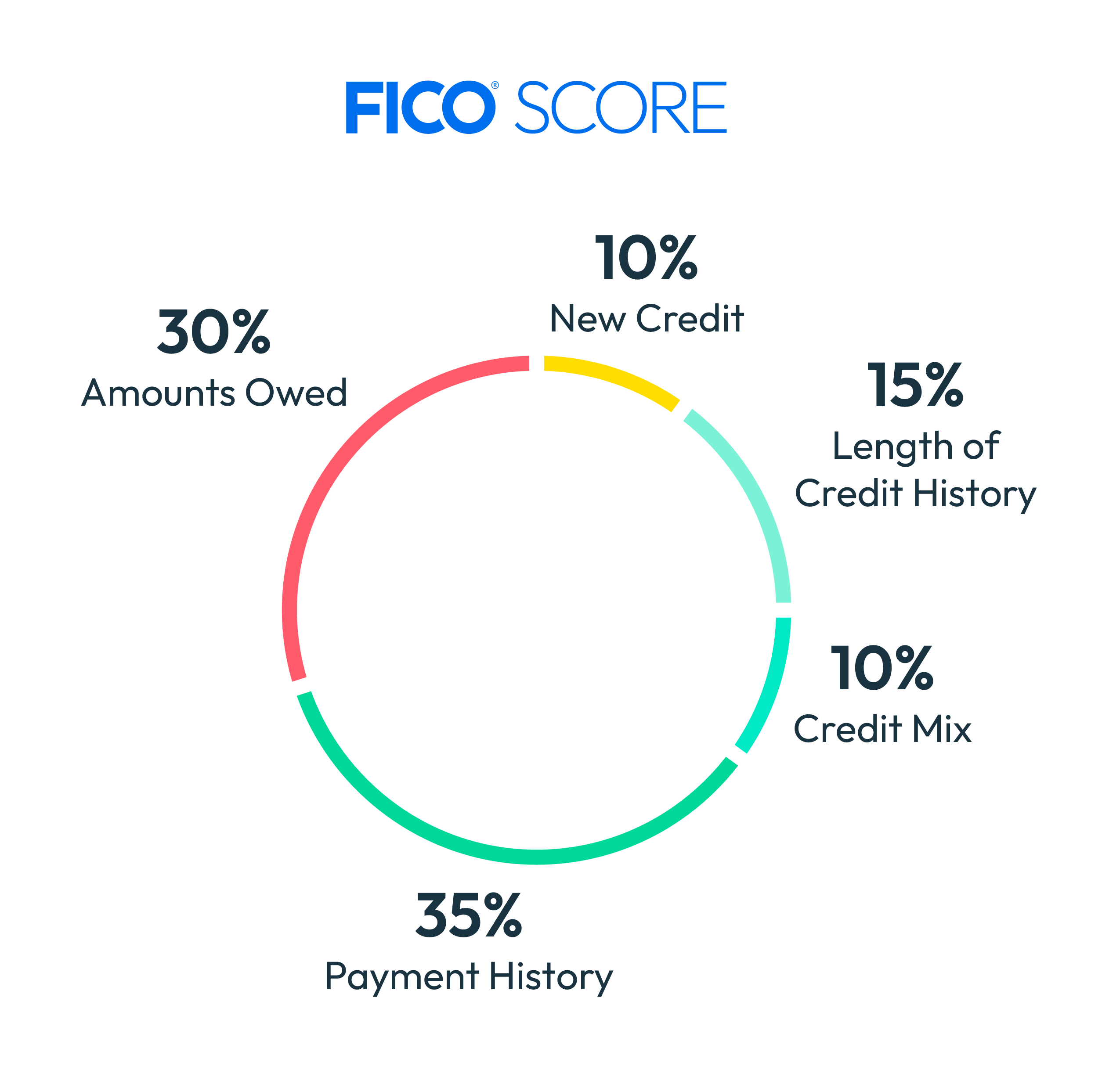

FICO scores are generally calculated using five categories of information contained in your credit reports, with varying weight given to each:

- Your payment history (35%)

- The amounts you owe, or credit utilization (30%)

- The length of your credit history (15%)

- The mix of your credit accounts (10%)

- Your new credit accounts (10%)

VantageScore is calculated with six categories of information contained in your credit reports. It doesn’t assign percentages to how much weight the categories are given, but instead describes their level of influence:

- Your payment history (extremely influential)

- Your credit utilization, or the percentage of your credit limits you’re using (highly influential)

- The length of your credit history and your mix of credit accounts (highly influential)

- The amounts you owe (moderately influential)

- Your recent credit behavior (less influential)

- Your available credit (less influential)

Breakdown of your FICO Credit Score

I’ve included the links if you want to look deeper into each category.

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to another—we’ll cover that in the next section.

The importance of credit categories varies by person

Your FICO Scores are unique, just like you. They are calculated based on the five categories referenced above, but for some people, the importance of these categories can be different. For example, scores for people who have not been using credit long will be calculated differently than those with a longer credit history.

In addition, as the information in your credit report changes, so does the evaluation of these factors in determining your FICO Scores.

Your credit report and FICO Scores evolve frequently. Because of this, it’s not possible to measure the exact impact of a single factor in how your FICO Score is calculated without looking at your entire report. Even the levels of importance shown in the FICO Scores chart above are for the general population and may be different for different credit profiles.

Your FICO Scores only look at information in your credit report

Your FICO Score is calculated only from the information in your credit report. However, lenders may look at many things when making a credit decision, such as your income, how long you have worked at your current job, and the kind of credit you are requesting.

What categories are considered when calculating my FICO Score?

Payment history (35%)

The first thing any lender wants to know is whether you’ve paid past credit accounts on time. This helps a lender figure out the amount of risk it will take on when extending credit. This is the most important factor in a FICO Score.

Learn more about payment history

Amounts owed (30%)

Having credit accounts and owing money on them does not necessarily mean you are a high-risk borrower with a low FICO Score. However, if you are using a lot of your available credit, this may indicate that you are overextended—and banks can interpret this to mean that you are at a higher risk of defaulting.

Length of credit history (15%)

In general, having a longer credit history is positive for your FICO Scores, but is not required for a good credit score.

Your FICO Scores take into account:

- How long your credit accounts have been established, including the age of your oldest account, the age of your newest account and an average age of all your accounts

- How long specific credit accounts have been established

- How long it has been since you used certain accounts

Learn more about length of credit history

Credit mix (10%)

FICO Scores will consider your mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. Don’t worry, it’s not necessary to have one of each.

New credit (10%)

Research shows that opening several credit accounts in a short amount of time represents a greater risk—especially for people who don’t have a long credit history.

Credit Score Rumors & Myths Debunked

Sometimes you are talking to a friend and they tell you something you’ve heard, and now there is this misconception of how credit works. Lets debunk these credit myths once and for all!

Rumor #1: Checking my credit lowers my score!

False. This is probably the most common myth. I hear this on a daily basis when pulling somebodies credit. Monitoring your score helps you track progress when building credit, but it is important to check it the right way. You might not want to repeatedly apply for new loans or credit cards if you likely won’t get approved or you’re preparing for a major purchase, like a new car or home.

However, you don’t need to let fear of hard inquiries keep you from finding the right lender. You will see a separate inquiry on your credit report from each of these lenders, but your credit score won’t be penalized for each one. Most credit scores will count multiple inquires for mortgage as one if they are made within a certain period of time (14-30 days)

Rumor #2. Carrying a balance on my credit card boosts my credit score

False. Carrying a balance on your credit card doesn’t help your credit score, it only has the potential to hurt it and it will end up becoming expensive over time paying interest. Not to mention, it’s a waste of money to pay interest on your balance if you can afford to pay off your credit card bill in full each month.

Lingering balances on your account directly affect your credit card utilization rate. The higher your credit card balance, the higher your utilization rate, which can in turn hurt your credit score. The good news is, once that balance is paid down or off your score will rocket up next month.

If you’re already carrying a balance on a credit card, consider transferring it to a balance transfer credit card with 0% on balance transfers, and commit to paying that card off in that time. Another strategy is to get a credit card that offers 0% interest for 12-24 months. Once the 0% is over, get a new card with the same offer.

Rumor #3. My income impacts my credit score

False. Your salary and income are considered measurements of your capacity to pay bills, not your potential credit risk. Would you want to let a friend borrow money (that you expect to get back) who doesn’t pay their bills?

While it’s good to know that the size of your paycheck has no influence on whether you have good or bad credit, you should know what does impact your score. Variables include your payment history, amounts owed (utilization rate), length of credit history, new credit (how often you apply for and open new accounts) and credit mix (the variety of credit products you have).

Rumor #4. A good credit score means you’re rich

False. Credit scores are just a measure of your risk (whether you pay your bills on time and in full). “A good credit score means you’re a good credit risk.

Having a high salary doesn’t guarantee a higher line of credit, but if you update your income with a card issuer to a higher amount, you may see an increase in your credit limit, which could be positive for your credit utilization ratio (as long as you continue to pay your balance in full each month). The more you utilize that higher amount is what gives card issuers the confidence that you can handle higher and higher credit limits.

I’ve found in my personal experience, you can request and receive a credit line increase every 6 months depending on the usage of that card. The higher credit limit can also lower your utilization. A $1000 balance on a limit of $2000 is 50%. But if you got a credit limit increase to $5000, now that same balance is only 20% usage on the same card, effectively raising your score and not paying off the debt.

Rumor #5. A perfect credit score doesn’t really matter

True. While it would be fun to say you are in the elite 850 club, there are no additional benefits of having a perfect score. No loan and credit products exist that are only available for people with perfect scores, and once you reach a certain score, you pretty much get all the same benefits anyways.

Once your score hits 760, you are at the top tier of credit benefits.

Rumor #6. I don’t need to worry about my credit score until I’m older

False. The minimum age at which you can apply for credit is 18 and that’s when you should start worrying about your credit score. Financial experts recommend young people start building credit as soon as possible. The length of your credit history is a big factor in your credit score, so the sooner you establish credit the better.

For those just beginning their credit journey, a trick relatives or parents will do is put their children on their credit cards as an Associate User, which gives you the benefits of the long standing history.

Rumor #7. Paying off debt increases your credit score

True and false. This is true for credit card debt, but not so true for installment debt, such as a mortgage or student loan. While it is good for your overall financial life to be totally debt free, you won’t see a bump in your credit score if you pay off your car loan, for example. It can actually ding your score because it means having fewer credit accounts. That doesn’t mean you shouldn’t pay off the loan, though; you don’t want to pay unnecessary interest over time just to save a few credit score points.

Because credit cards usually have higher interest rates than installment loans, paying off credit card debt first can help you while also improving your score (if you lower your credit utilization).

Rumor #8. My employer can see my credit score

False. When it comes to applying for a new job, people often think prospective employers can see their credit score. While they can pull your credit report, the type of credit report that employers have access to does not include your actual credit score.

What employers do see when they run a credit check is your debt and payment history so they can look for any signs of financial distress.

Rumor #9. Student loans don’t affect my credit score

False. Your credit score isn’t just impacted by your credit card bills. You need to pay all your bills on time, which includes your utilities, student loans, mortgage and any medical bills you might have.

Defaulting on student loans can prevent you from taking advantage of an FHA Loan for instance.

If you struggle to remember to pay your bills each month, there’s an easy fix: autopay. In the case of student loan companies, some give you a discount on your interest rate if you set up autopay.

Rumor #10. Getting married will merge my credit score with my spouse

False. When you get married, your credit report stays unique to you and only you. Marrying somebody with poor credit does not mean you will have poor credit.

When it comes to applying for new credit with your partner, such as filling out a joint application for a mortgage, each partner’s credit score is taken into consideration by the lenders. Once a joint loan is opened, the positive and negative actions both you and your spouse take are reflected on both of your reports.

Rumor #11. Using debit cards helps build a good credit score

False. Debit and credit cards are two entirely different things. Since debit cards are not a form of credit, they never end up on your credit reports and thus have no influence on your credit score.

Rumor #12. Closing a credit card improves my credit score

False. Closing a credit card will never improve your credit score — in fact, it’s likely to ding your score and that’s one reason experts generally don’t recommend it. But there are some specific circumstances to think about before deciding whether or not to cancel your credit card.

If your card has no annual fee, then there’s really no harm in keeping it open. But if you’re losing money on the card, you can call up the card issuer and ask if you can switch to a no annual fee credit card. If you’re being charged a high interest rate, it might be beneficial to close a credit card.

Rumor #13. Selecting ‘credit’ while using my debit card for a purchase helps raise my credit score

False. If you choose “credit” instead of “debit” next time you’re at the cash register, know that your credit score will not be affected in any way since your debit card activity does not get reported to the credit bureaus. Debit cards have no effect on your credit history nor credit score, so whether you use your debit card as debit or credit, the money is still withdrawn directly from your checking account.

Rumor #14. Charging a high balance and paying a higher balance every month gives me a better score.

False. While paying your cards balance off every month is great for your score. Even paying multiple times per month so you don’t incur interest charges is great for your credit score! However the AMOUNT you charge does not change the amount your score changes. Somebody who charges $50 a month and pays it off every month, will get the same score benefits as somebody who charges $5000 a month and paying it off.

Credit utilization is % based, NOT amount based.

- $100 balance on a card with a $1000 limit is 10% usage

- $2000 balance on a card with a $20,ooo limit is also 10% usage

Both of these cards will give the same credit score benefits.

What is a Credit Report?

A credit report is a summary of your personal credit history. Your credit report includes identifying information — like your address and date of birth — and information about your credit history — like how you pay your bills or if you filed for bankruptcy. Three nationwide credit bureaus (Equifax, Experian, and TransUnion) collect and update this information. Not all creditors report information to credit bureaus, but most nationwide chain store and bank credit card accounts, along with loans, are included in credit reports.

The information in your credit report can affect your buying power. It can also affect your chance to get a job, rent or buy a place to live, and buy insurance. Credit bureaus sell the information in your report to businesses that use it to decide whether to loan you money, give you credit, offer you insurance, or rent you a home. Some employers use credit reports in hiring decisions. The strength of your credit history also affects how much you will have to pay to borrow money.

The credit bureaus must

- make sure that the information they collect about you is accurate

- give you a free copy of your report once every 12 months

- give you a chance to fix any mistakes

The Fair Credit Reporting Act (FCRA), a federal law, requires this.

What is a Credit Score?

A credit score tells lenders about your creditworthiness (how likely you are to pay back a loan based on your credit history). It is calculated using the information in your credit reports. FICO® Scores are the standard for credit scores—used by 90% of top lenders.

Credit scores influence the credit that’s available to a person and the terms (interest rate, etc.) that lenders may offer. It’s a vital part of credit health.

When you apply for credit — whether for a credit card, an auto loan or a mortgage—lenders want to know what risk they’d take by loaning money. When lenders order a credit report, they can also request a credit score that’s based on the information in the report. A credit score helps lenders evaluate a credit report. It is a number that summarizes credit risk, based on a snapshot of a credit report at a particular point in time.

It’s important to understand that not every credit score offered for sale online is a FICO Score.

About FICO Scores

The most widely used credit scores are FICO Scores, the credit scores created by Fair Isaac Corporation. 90% of top lenders use FICO Scores to help them make billions of credit-related decisions every year. FICO Scores are calculated based only on information in a consumer’s credit report maintained by the credit bureaus, Experian, Equifax and TransUnion.

By comparing this information to the patterns in hundreds of thousands of past credit reports, FICO Scores estimate your level of future credit risk, or how likely you are to repay a loan on time.

What is a good credit score?

Most credit scores have a 300-850 score range. The higher the score, the lower the risk to lenders. A “good” credit score is considered to be in the 670-739 score range.

| Credit Score Ranges | Rating | Description |

| <580 | Poor | This credit score is well below the average score of U.S. consumers and demonstrates to lenders that the borrower may be a risk. |

| 580-669 | Fair | This credit score is below the average score of U.S. consumers, though many lenders will approve loans with this score. |

| 670-739 | Good | This credit score is near or slightly above the average of U.S. consumers and most lenders consider this a good score. |

| 740-799 | Very Good | This credit score is above the average of U.S. consumers and demonstrates to lenders that the borrower is very dependable. |

| 800+ | Exceptional | This credit score is well above the average score of U.S. consumers and clearly demonstrates to lenders that the borrower is an exceptionally low risk. |

While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.

Why is my credit score high or low?

When a credit score is calculated, the credit bureau will also provide up to five reasons that are most heavily influencing that particular score.

Different scores at each credit bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

What are the minimums to even have a FICO Score?

In order to receive a valid FICO Score, the credit report must have:

- At least one account opened for six months or more, and

- At least one account that has been reported to the credit bureau within the past six months, and

- No indication of deceased on the credit report (Please note, if you share an account with another person this may affect you if the other account holder is reported deceased).

The minimum scoring criteria may be satisfied by a single account or by multiple accounts on a credit file. In certain rare cases, whether a given credit report qualifies for a FICO Score may vary across different FICO Score versions.

Does my FICO Score change over time?

In general, FICO scores do not change that much over time. But it’s important to note that your FICO score is calculated each time it’s requested; either by you or a lender. And each time it’s calculated it’s taking into consideration the information that is on your credit report at that time. So, as the information on your credit report changes, your FICO score can also change.

How much your FICO score changes from time to time is driven by a variety of factors such as:

- Your current credit profile – how you have managed your credit to date will affect how a particular action may impact your score. For example, new information on your credit report, such as opening a new credit account, is more likely to have a larger impact for someone with a limited credit history as compared to someone with a very full credit history.

- The change being reported – the “degree” of change being reported will have an impact. For example, if someone who usually pays bills on-time continues to do so (a positive action) then there will likely be only a small impact on their score one month later. On the other hand, if this same person files for bankruptcy or misses a payment, then there will most likely be a substantial impact on their score one month later.

- How quickly information is updated – there is sometimes a lag between when you perform an action (like paying off your credit card balance in full) and when it is reported by the creditor to the credit bureau. It’s only when the credit bureau has the updated information that it will have an affect on your FICO score.

Keep in mind:

Small changes in your score can be important if you’re looking to obtain a certain FICO score level or if you are striving to reach a certain lender’s FICO score “cutoff” (the point above which a lender would accept a new application for credit, but below which, the credit application would be denied).

How can I get a free copy of my Credit Report?

How do I order my free annual credit reports?

The three nationwide credit bureaus — Equifax, Experian, and TransUnion — have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three credit bureaus individually. These are the only ways to order your free annual credit reports:

- visit AnnualCreditReport.com

- call 1-877-322-8228, or

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Only one website — AnnualCreditReport.com — is authorized to fill orders for the free annual credit reports you are entitled to by law.

How often can I get a free report?

Federal law gives you the right to get a free copy of your credit report every 12 months from each of the three nationwide credit bureaus. In addition, the three bureaus have permanently extended a program that lets you check your credit report from each once a week for free at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year from Equifax through 2026 by visiting AnnualCreditReport.com. That’s in addition to the one free Equifax report (plus your Experian and TransUnion reports) that you can get annually at AnnualCreditReport.com.

For more info please visit the FTC Website concerning Free Credit Reports.

Credit Counseling

When it comes to the decision of credit repair, it would be a decision that we can discuss if the issues go deeper than what we can solve. We have many referrals if you’d like to use them. However you are free to choose anybody you’d like, or even none at all if you prefer. If there are major issues with your credit, sometimes it is better to trust an expert who knows the ins and outs of this world.

Are there rules for credit repair companies?

It’s illegal for credit repair companies to lie about what they can do for you, or charge you before they help you. Credit repair companies must also explain your legal rights in a written contract that details

- the services they’ll perform

- your three-day right to cancel without any charge (and give you a written cancellation form)

- how long it will take to get results

- the total cost you’ll pay

- any results they guarantee

How do I know if I’m dealing with a credit repair scam?

Here’s how to know if you’re dealing with a scammy credit repair company:

- Scammers insist you pay them before they help you.

- Scammers tell you not to contact the credit bureaus directly.

- Scammers tell you to dispute information in your credit report you know is accurate.

- Scammers tell you to lie on your applications for credit or a loan.

- Scammers tell you to file a false identity theft report.

- Scammers don’t explain your legal rights when they tell you what they can do for you.

Loan Options

Resources