Purchase

Buying a house for the first time is an exciting milestone! Whether you want to stop renting, relocate, or expand your family, we’re here to help you on your home buying journey. This step-by-step guide sheds light on the home buying process and includes valuable tips and tricks to help you along the way. It’ll help you understand what a typical home purchase looks like from start to finish. Remember that every home buyer’s journey is different. Yours might be slower or faster depending on a wide range of factors.

Ready to get started? Let’s dive in.

Steps to buying a house

- Deciding if buying a home is right for you

- Determining your budget.

- Getting a mortgage (call me to get pre-approved)

- Finding your home

- Making an offer

- Going through the loan process.

- Preparing to close on your home

- Getting ready for closing day

Final thoughts on how to buy a house

Factors such as your current financial situation, whether or not you have a hard deadline and the availability of homes can all play a role in determining how long it takes you to buy. Whether you’re looking to buy quickly or have time to spare, a phone call with me can help answer the questions you have. Also there may be programs available that you didn’t know exist that could get you into home ownership sooner than you thought.

Deciding whether home ownership is right for you

Consider your reasons for buying, then decide if it’s the right time to commit. Before starting the home buying journey, it’s good to pause and make sure that it’s the right decision for you. Here are some factors you may want to think about before buying a home.

Figure out why you want to buy?

It’s important to understand why you’d like to buy. Knowing what you’re looking for is the first step to finding the home of your dreams. Home ownership is a solid foundation for your family. Owning a home builds equity over time, creating a store of wealth you can use in the future or pass on to future generations.

Should you rent or buy a home? Buying a home gives you more flexibility than renting, since you own it and can do what you want. It gives you the freedom to transform your living space into a place that feels truly yours. If you’re already a homeowner, you may want to find a new place in a different location or one that fits your changing needs. Knowing what you want out of a house will make it easier to decide where to live, what features you want and how much you’re willing to spend.

When you’re buying a home, it can be helpful to understand what’s going on in the real estate market. Conditions in the housing market can affect how long it takes you to find a home and the final price you pay. Depending on the supply and demand of homes, the market may favor either buyers or sellers.

What’s a buyer’s market?

A buyer’s market happens when there are more houses for sale than there are people looking to buy. Sellers may be willing to lower their asking price to make a sale, which benefits buyers. You can browse online real estate listings to look for clues about what’s happening in the market or talk to your real estate agent.

Signs of a buyer’s market include:

- Homes stay on the market longer.

- Selling prices are below average.

- There’s a recent history of price drops.

- More property listings available than usual.

What’s a seller’s market?

A seller’s market means that there are more people looking for homes to buy than there are people putting houses up for sale. When that happens, buyers may face higher competition, leading to faster sales and fewer price drops.

Signs of a seller’s market include:

- Homes sell faster.

- Selling prices are above average.

- Prices haven’t dropped much recently.

- There are fewer property listings.

While knowing whether it’s a buyer’s or seller’s market is valuable in your search, the right time to buy is dependent on your unique situation. Many people still buy in a seller’s market and sell in a buyer’s market.

Evaluate your credit score and finances

First, it’s helpful to check your credit score and make sure your finances meet the requirements for buying a house.

Click here for a guide to everything about your credit!

Before you start searching for a house, it can help to save as much money as you can. This can help you get preapproved and put together a competitive offer. However, here’s the good news:

You don’t need to have enough money in the bank to buy a home outright.

In 2021, 78% of homebuyers financed their homes with mortgage loan. So, the question you want to ask yourself is, “Am I able to qualify for a home loan?” Start by checking your credit score.

Most conventional loans require a minimum credit score of 620, but a higher score can improve your chances of getting approved and securing lower interest rates.

If your score is lower than 620, you still have options.

There are a number of options for home loans with low credit. Steps like making payments on time and reducing debt can improve your credit score.

Determining your budget

Do your homework on your financial situation to determine what you can afford.

If you made it to the end of step one and decided that it’s the right time to buy a home, then the next step is setting a budget to help narrow your search. Here are some of the most important factors to keep in mind when figuring out how much you can spend on your new home.

Set your housing budget

After you’ve checked your credit score to confirm you’re ready to apply for a loan, it’s a good idea to figure out how much you want to spend on a monthly mortgage payment. This is something we will talk about in our first phone call. Choose a payment you are comfortable paying for. Do not base your budget off a house price.

If you have been looking on websites such at Zillow, please be careful when looking at their payment calculator. They can be misleading since they set the default down payment at 20%. Unfortunately many people don’t notice this and they get an unrealistic idea of the type of house they can afford.

Factor in other expenses

When you buy a car, it comes with ownership expenses like gas, insurance, and maintenance.

The same is true for home ownership. It’s a good idea to factor in the other costs of ownership on top of your mortgage. That helps you prepare for costs that come up during and after a home purchase.

The first cost to consider is mortgage closing fees and costs, which run from about 2% to 4% of the total price of the house on average.

After that, it can help to think about the total cost of ownership, which includes the expenses you take on once the house is yours. We’ll cover that next.

Here are some of the additional costs of owning a home:

- Property taxes: This will be included in your mortgage payment. However if you are in IL, I always recommend looking at the property taxes first before the price of the home. We live in one of the highest taxed area’s in the country.

- Homeowners insurance: As of 2022, the average annual rate ranges from $558 to $4,122, depending on your home’s location.

- Utility bills: Depending on the size of the home. You have gas, electric, water, trash removal & Internet.

- Maintenance and repairs: I recommend budgeting 1% to 2% of your total mortgage amount for your annual repair budget.

While these are general guidelines, it can be helpful to research the rates that apply to the neighborhood where you’ll be living to get the most accurate estimates.

Put together your down payment

You may have heard that you’ll need to put down a 20% down payment if you want to buy a house. This is no longer true. There are loan down payment assistance programs that allow 0% down. The avg down payment is between 3-5%. However you can put down as much as you choose.

Many first-time home buyers are able to finance their homes using low down payment options. These make it possible to get loans with a minimum down payment as low as 3%.

That being said, if you can’t put down 20%, you will be required to have Private Mortgage Insurance (PMI). PMI protects lenders in case of default, and typically costs you an extra 0.55% to 1.86% each month. If you can make a down payment of 20%, PMI is not required. PMI is factored into the payment when we talk about your budget for a mortgage.

If you don’t have enough saved, you can find the money for your down payment by setting a budget to build savings, finding a second source of income or searching for down payment assistance programs. At this stage, it’s also helpful to set aside money for closing costs. These are additional fees that you need to pay before you get the keys to your new house. We’ll go into more detail on that in the closing step. Closing costs vary depending on your state, but it’s a good idea to budget 3% to 4% of your maximum home purchase price for those fees.

Getting a Mortgage (Call me to get pre-approved)

Before you look at any homes, getting pre-approved with us is always a great idea! Not only does it let sellers take your offer serious. But during that initial phone call, we will go over the process. This way I can answer any questions you have and let you know what to expect. When you are making the largest purchase in your life, you need to be informed. During this initial call, we will go over your income and what you qualify for. What payment you are comfortable paying and getting you looking at houses you can afford. Your credit and any red flags that might cause an issue, and down payment options. On top of that if you have any questions you read about on google, mention them. I want you to be comfortable with the entire process and info you are given.

Using me as your mortgage advisor is much more than a Pre-approval. I also contact the listing agent on your offers to make sure they understand just how good of a borrower you are! This has won us many contracts over the years. You are not just another deal on the wall. I love getting to know my clients and helping them get what they want, and how they want it.

Get a pre-approval

Learn about the types of pre-approvals there are and why they are not all created equal. Not to mention, having a mortgage preapproval is a major advantage for you. Getting pre-approved shows sellers that you’re a serious buyer. In fact, some real estate agents won’t let buyers tour a house without it.

Click here for whats necessary to buy a home

Click here for the difference between a preapproval and prequalification.

Take the first step of pre-approval

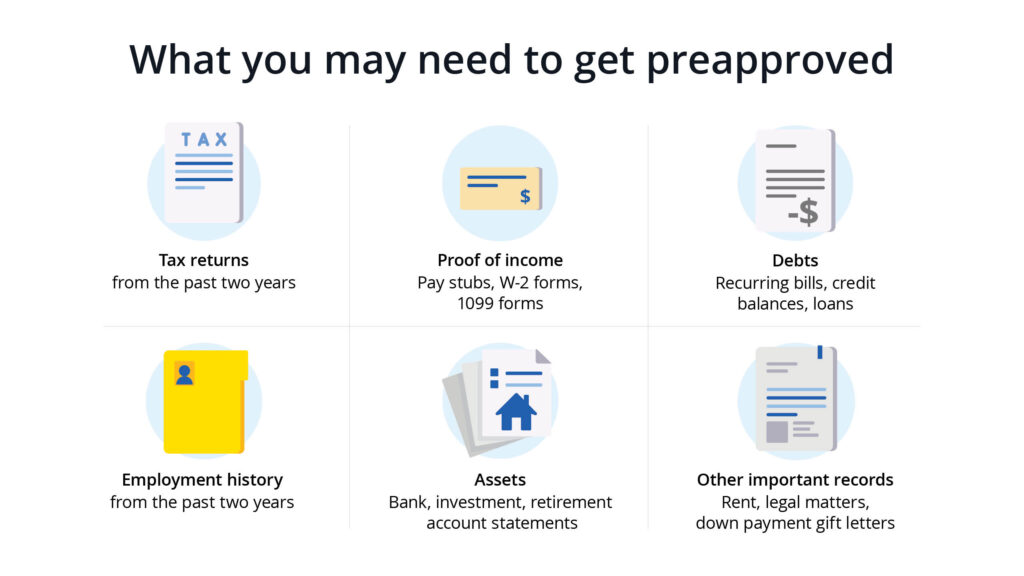

When you apply for a pre-approval, you can speed up the process by having your tax returns, proof of income and employer information from the last two years handy.

Once you’re pre-approved, it’s important to avoid any major changes to your financial situation until you close on a home.

During the time you’re shopping for homes and negotiating offers, try not to:

- Open new credit cards

- Take out new loans

- Make major purchases

- Spend your bank account low

These are the common mistakes buyers might make. If something happens and you need to purchase a car lets say, please call and talk to me about this, it may not necessarily affect your loan. But we do need to make sure if does not disqualify you from the house you want.

Loan Types

When choosing your mortgage, it’s helpful to have options. Here are some of the common loan types to know about when starting your journey. During our initial call, we will discuss different options based on what you qualify for and your goals with owning a home.

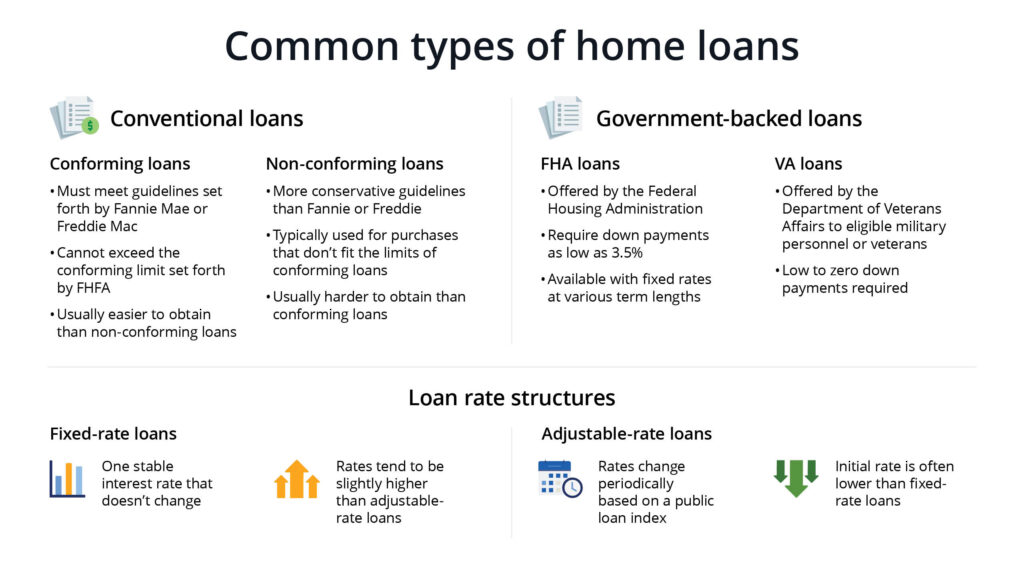

Conventional mortgages

Conventional loans are provided by private lenders like banks. They can be divided into two mortgage loan types: conforming and non-conforming.

Conforming loans meet certain government guidelines, and can’t go above a limit set by the Federal Housing Finance Agency (FHFA).

Following these guidelines makes conforming loans eligible for purchase by Fannie Mae or Freddie Mac, so they’re safer for lenders. As a result, they’re also usually easier to obtain than non-conforming loans.

Non-conforming loans, or jumbo loans, don’t follow the federal guidelines. They are usually used for home purchases that are more expensive than the conforming limits.

Government-backed loans

In addition to conventional mortgages, you can also get a government-backed loan. You can access these through lenders like us, just like conventional loans. However, they are also insured by government programs like the Fair Housing Administration (FHA) and the Veterans Affairs (VA) department.

FHA loans are backed by the Federal Housing Administration and offer mortgages with as little as 3.5% down with various term lengths and fixed rates. FHA loans also allow specialty programs like down payment assistance loans to help you buy a home with 0% down, while securing an FHA loan.

A VA loan on the other hand, provides low or no down payment options to qualifying military personnel and veterans.

Fixed vs. adjustable-rate mortgages

Some lenders offer adjustable-rate mortgages (ARMs), which use a fixed rate for a period of time and then continue to adjust (usually every six months) based on a reference index. Majority of loans are fixed, however for a specialty type of situation an adjustable rate might make sense. Previously ARM products use to carry a lower interest rate in trade for the short term before it adjusts. However in modern lending times, the rates are nearly identical to a fixed rate and does not make sense to utilize.

Your monthly payments can end up increasing or decreasing based on the index. ARMs are less predictable than fixed-rate mortgages, but they may offer some savings if your interest rates decrease.

If you’re unsure which rate is right for you, we can discuss the pros and cons of the product and you can decide which is best.

Finding your home

* The right Real Estate Agent can make the difference between you getting and losing the home of your dreams.

* With your finances in order, it’s finally time for the fun part of buying a house: finding it!

Hire a real estate agent

If you are looking to buy a CONDO, click here for our Condo Corner!

It’s easy to feel like you’re lost in the home buying process, especially the first time around. Working with a real estate agent with experience and know-how can make the process feel less overwhelming. A buyer’s agent can also help you find a home in your price range and negotiate your offer.

Taking time to find a real estate agent makes the rest of the process smoother. If it’s your first time buying, you need to feel comfortable with your Realtor as well. I have plenty of agents I have worked with who are amazing at what they do and how they treat people.

Every agent is essentially their own business. They do things how they determine is best. Knowing this it can make the selection process a bit more difficult. The good news is you are not stuck with any certain realtor if you do not like them. Same with lender, we all work for you, and you are in control of who in apart of your buying team! However be careful if the family or friend is a realtor themselves. Many people keep full time jobs and have a realtors license and use the industry as a 2nd job.

It can help to prepare a list of questions to ask an agent before you hire them. These questions can give you an idea what they’re best at and what it’ll be like to work with them:

- Most important: Is this your full time job? If they say no, this is a red flag. You don’t want somebody who is looking for a side paycheck handling the largest purchase of your life. You could end up paying more for the home, losing out on credits and not getting offers accepted due to inexperience.

- Have you already worked with clients who purchased homes in the neighborhood/area where I’m looking to move?

- How many homes do you usually show buyers before they make an offer?

- How often do you send your clients new listings?

- Do you see any trends in my chosen location that could affect home prices now or in the future?

Before working with an agent, it’s good to verify their credentials. Don’t let a brokerage determine the quality behind the person.

Prioritize your preferences

As you start house hunting, it’s helpful to think about the type of home you want and the features you’d like.

Here are some factors to consider:

- Number of bedrooms

- Number of bathrooms (half vs. full bathrooms)

- Number of floors

- Attached garage vs. detached garage

- Number of parking spaces

- Water source (water main or well)

- Waste disposal (sewer or septic)

- Finished basement, unfinished basement or no basement

- Pantry size

- Yard size

- Outdoor features (like a porch or patio)

- Location (distance to schools, public transportation, highways, etc.)

Once you have your list of wants, you can prioritize them by separating your checklist into must-haves and nice-to-haves. Be sure to think about how long you want to live in this home.

For example, if you plan to expand your family, you want to make sure you have enough room.

Start browsing

Once you’ve set a budget, gotten preapproved for a loan and found a buyer’s agent, it’s time to start browsing the market for your dream home.

When touring homes, you’ll want to have your agent with you so they can learn more about your preferences. Your agent can also help with a wide variety of tasks at this stage like:

- Researching homes to find information like how long they’ve been on the market.

- Interacting and negotiating with sellers’ agents.

- Answering any questions you might have about the process.

- Finding and scheduling showings.

- Telling you about anything else you might need to look out for.

It’s helpful to prepare some questions to ask when viewing a house so you can get to know the property better.

You can also take advantage of new ways to tour homes like video chatting with a real estate agent. Some listings websites offer online 3D virtual tours that can help you decide which properties to see in person. Whether you see a home online or in person, it’s helpful to take notes during your tour. That way, you’ll remember how you felt about each place when it’s time to decide.

Making an offer

Make an offer with the help of your real estate agent. If the seller agrees, be prepared to negotiate and put down some money (Earnest $) to secure the offer.

Once you’ve chosen your ideal property, it’s time to work with your agent to put together an offer. At the same time, you may also work with your lawyer to put together the contracts, financial documents, and title information that makes everything else possible.

Here’s what putting together an offer looks like.

How much to offer

Selecting the right offer amount usually involves looking at market conditions, such as the sale price of other homes in the area. Your buyer’s agent can help you decide how much to offer based on your budget and the sale prices of similar homes. Your agent can also recommend contingencies, which are conditions that the seller has to meet before you buy (such as passing a home inspection).

A contingent offer can protect buyers. It ensures that if something goes wrong or the seller doesn’t meet your terms, you can safely back out.

Provide a complete offer package

When you make an offer on a home, you don’t just send over a number. Your agent will put together an entire offer package that includes information like:

- Your offer price.

- Your pre-approval letter.

- Include us (your lender) in the offer email in case the listing agent has questions.

- The offer’s expiration date.

The offer will also suggest terms and contingencies, such as a list of closing costs and who’s responsible for each.

Prepare for a counteroffer

Negotiations are common in the home buying process, so be ready for the seller to make a counteroffer.

In addition to negotiating the selling price, they might want to change the terms or contingencies of your offer. For example, if you’re selling your house and buying another, the seller might set a contingency saying that you have to sell your current house before closing on the new one.

If the seller sends a counteroffer, you have three options:

- 1. Accept it.

- 2. Reject it and move on to another property.

- 3. Send another counteroffer.

Your agent can be one of your best resources here. They can take some of the stress out of negotiations by advising you and advocating for you throughout the home buying process. This is why an experienced agent matters.

Accepting an offer isn’t the same as closing. You can still back out after the seller has accepted your offer, but they might get to keep your earnest money if you change your mind. However, if something goes wrong or the seller doesn’t meet a contingency, you can usually back out and get your earnest money back.

There are 2 major contingencies that will protect your earnest $. The first is the 5 day attorney review period. Which is 5 days after you both sign the contract. This is the time you have your inspection done. If there are any issues you determine are enough to walk away, you can and your earnest money is returned. The second is a mortgage contingency. During the loan process, if for any reason you do not qualify for the mortgage to purchase the property, this protects your earnest money. The most common way to lose your earnest $ during a contract is if you make the personal choice to cancel after the 5 day attorney review is up.

Having your offer accepted is a major step toward closing your new home. There’s still more work to do, but you’re well on your way to getting the keys.

The Loan Process

When you’re ready to buy, it’s time to secure financing and get your loan closed!

This is where the realtors job is essentially done and our job (your lender) begins. At this point, you’ll give a copy of the signed purchase contract to a lender so they can move on to the next step of securing your mortgage. (Generally the realtor will send a copy) Having a pre-approval will make this step faster.

Once a lender has your signed purchase contract and mortgage application, they can start the underwriting process.

What’s Mortgage Underwriting?

Mortgage underwriting is how lenders go over loan applications. They use this process to determine if you’re likely to pay back your loan, and will approve or deny it based on the results. This is also where the prep work we have done to make sure there are no issues will show up. This is why we talk about your details and get the documents from you before you even look at a home.

Generally there are 3 people involved in this portion of a transaction (Some banks have many more) Those 3 people are: Loan Officer (Me), my Processor, and the Underwriter. My processor will handle majority of the back end paperwork (ordering title, getting insurance setup, verifying your work etc). The Underwriter is like the Judge in a courtroom, they make the final decision on your loan and determine what documents are necessary to evaluate the risk that you will repay the loan.

There are 2 types of Underwriter. In House and Not in House. If an UW is not in house, that means a broker (middleman) is sending it to another bank who has an UW to evaluate your loan. However when a lender has IN HOUSE Underwriting (Which we do here at Geneva). This means we have our own Underwriters that we work with on a consistent basis and can get quick answers if there are questions. This is beneficial to you as the buyer because we are familiar with the types of documents the UW will ask for. Making it an easier process to repeat so you don’t have any surprises.

Here are just a few things an underwriter will consider:

- Your income and employment history

- Your financial assets

- Your existing debts

- Your credit history

- Your loan amount

- Your loan type

- How much your home appraises for

What’s an appraisal?

Most lenders require that you get a home appraisal during the underwriting process. A home appraisal is a professional estimate of the property’s market value performed by an unbiased third party.

What is the difference between an appraiser and the inspector? An Inspector is optional (Although always recommended), and there to give you an extensive report about everything right and wrong with the property. Repairs they recommend and the age of key items such as the roof, HVAC, and other big ticket items. This report is used to negotiate repairs from the seller. The appraiser is sent by us (the lender) to assess the market value of the home.

Keep in mind that your home might appraise for a different value than the actual purchase price.

Preparing to close on your home

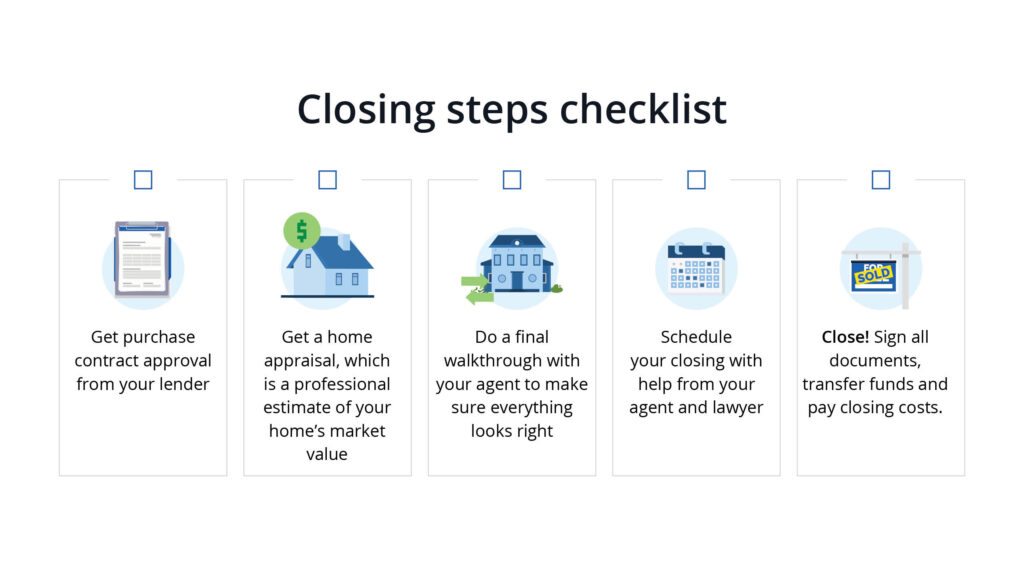

You’ll need to get a few more things done before you close, including getting a final home inspection if you choose to. Sometimes sellers need to make repairs and this is your last chance to verify they were done correctly.

Once a seller accepts your offer (or you accept a counteroffer), you have the chance to take a closer look at your future home and see if anything needs repairs. Negotiations and contingencies will determine whether you or the seller has to handle them.

Getting ready for closing day

Do a final walk through and then close on the house.

Tip: When working with me, I send you the final numbers as soon as I have them. This way we can go over the payment, all the costs, how much you need to bring to closing and answer any questions you have before you get to the closing table. The attorney does this at the closing table also. I prefer we go over this beforehand. This way closing day is a day to celebrate! Not a day to be nervous because you haven’t seen the numbers.

You’ve made it to the home stretch. It’s time to prepare for closing day!

Final walk through

One or two days before you close on the house, you and your agent will do a final walk through of the home. You should bring your contract along so you can make sure that the seller has honored all contingencies. This is your last chance to see the home before closing. Don’t be afraid to check everything. Water, HVAC, lights etc. If repairs are suppose to be done, this is when you bring your inspector. Check to make sure nothing has changed or broken during the time since you last visited.

Tip: Take pictures of everything at the final walk through. This way if there is time in between, when you officially purchase it and you notice something changed. You have proof.

Sign and close

Closing day is the final step on your journey to becoming a homeowner. It’s the day when the ownership of the house officially gets transferred to you.

On closing day, you bring a cashier’s check or proof of wire transfer to cover closing costs. After closing is done and the wire transfer is finished you are officially a homeowner! You will receive a copy of the documents you signed, as well as the keys to your new home! (Sometimes the seller leaves them in the lockbox).

What are closing costs?

Closing costs are the added expenses associated with securing a home loan and transferring ownership. Examples include:

- Attorney fees

- Appraisal fees

- Title fees (to verify there are no tax liens and to cover owner’s title insurance)

- Loan origination fees

- Underwriting fees

What to expect on closing day

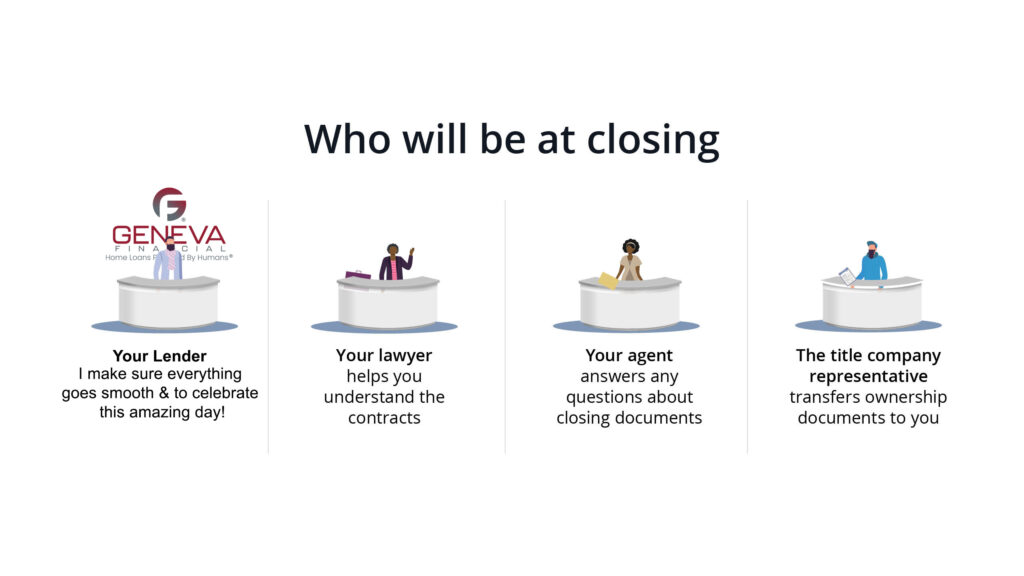

A lot of people will show up on closing day. Along with you and your agent, you’ll also need:

- Your lender. I go to every closing I am able to, first to celebrate this day with you. Also to make sure there are no issues.

- Your lawyer to help you understand the contracts. (Some states require lawyers for real estate closings)

- A representative from the title company, who transfers the home ownership documents from the seller to you.

- A closing agent who can answer your questions about the closing documents.

You want to avoid signing anything that you don’t understand. If you have questions, your real estate agent. lender (and your lawyer, if present) are there to help you.

Once you’ve signed all the documents and the seller has transferred ownership of the house to you, it’s officially yours! The seller will give you the keys to the house and you can start moving in.

Final thoughts on how to buy a house

Buying a home is an exciting step and may even mean fulfilling a long-time goal of yours. It may seem like a long journey, but with the right help, you can end up holding the keys to your dream home.

Sometimes situations can make you want to quit, but some advice I can give is to push through it. In 6 months or a year from now, you won’t think about any of the struggles it took. These will become a story, but you will be very happy you did and can sleep in your own home.

Now that the home buying process is done, its time to relax and enjoy. After you buy there are always little things to buy and do. Over the years I have worked with great people in various industries. I created a list of trusted people to go to if you are looking. They can be from shopping homeowners insurance, to buying a mattress. I get nothing in return for you using anybody on this list, but if you do mention I sent you, they do give a better discount sometimes.

List of Trusted Retail Partners

Loan Options

Resources